In this age of electronic devices, where screens rule our lives The appeal of tangible, printed materials hasn't diminished. It doesn't matter if it's for educational reasons project ideas, artistic or just adding an individual touch to your space, Is Inherited 1099 R Taxable are a great source. The following article is a take a dive into the sphere of "Is Inherited 1099 R Taxable," exploring what they are, where they are available, and how they can enrich various aspects of your lives.

Get Latest Is Inherited 1099 R Taxable Below

Is Inherited 1099 R Taxable

Is Inherited 1099 R Taxable -

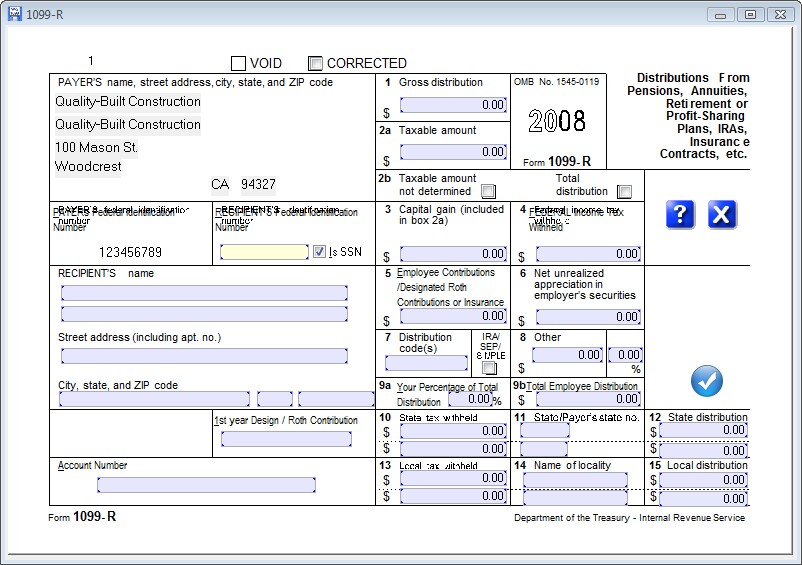

According to the IRS You should receive a Form 1099 R from the payer of the lump sum distribution showing your taxable distribution and the amount eligible for capital gain

1099 R inheritance tax treatment depends on whether it was inherited from a spouse or not You may have to pay income tax on the distribution based on the type of plan and the manner in which contributions were made by the decedent

Is Inherited 1099 R Taxable offer a wide array of printable materials that are accessible online for free cost. These resources come in various designs, including worksheets templates, coloring pages and more. The appealingness of Is Inherited 1099 R Taxable is their flexibility and accessibility.

More of Is Inherited 1099 R Taxable

1099 R Inherited IRA Or 401K With 4 In Box 7 YouTube

1099 R Inherited IRA Or 401K With 4 In Box 7 YouTube

This interview will help you determine for income tax purposes if the cash bank account stock bond or property you inherited is taxable The tool is designed for taxpayers who were U S citizens or resident aliens for the entire tax year for which they re inquiring

When a taxpayer receives a distribution from an inherited IRA they should receive from the financial institution a 1099 R with a Distribution Code of 4 in Box 7 This gross distribution is usually fully taxable to the beneficiary taxpayer unless the deceased owner had made non deductible contributions to the IRA

Is Inherited 1099 R Taxable have garnered immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

Flexible: The Customization feature lets you tailor printables to fit your particular needs, whether it's designing invitations or arranging your schedule or even decorating your house.

-

Educational Benefits: Printing educational materials for no cost offer a wide range of educational content for learners of all ages. This makes them a valuable tool for teachers and parents.

-

An easy way to access HTML0: instant access the vast array of design and templates, which saves time as well as effort.

Where to Find more Is Inherited 1099 R Taxable

How To Calculate Taxable Amount On A 1099 R For Life Insurance

How To Calculate Taxable Amount On A 1099 R For Life Insurance

We inherited an ira from my wife s father when he passed away that we moved into an inherited IRA after taking out the RMD We received a 1099 R showing the full IRA amount as taxable and TurboTax after entering the information wants to tax the full amount as if we cashed the whole amount

If you received a distribution of 10 or more from your retirement plan you should receive a copy of Form 1099 R Form CSA 1099R Form CSF 1099R or Form RRB 1099 R Pre tax contributions to pension and annuity accounts generally are included in taxable income when distributed

After we've peaked your curiosity about Is Inherited 1099 R Taxable Let's see where you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of Is Inherited 1099 R Taxable designed for a variety purposes.

- Explore categories like design, home decor, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free along with flashcards, as well as other learning materials.

- This is a great resource for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers post their original designs or templates for download.

- These blogs cover a wide range of topics, that includes DIY projects to party planning.

Maximizing Is Inherited 1099 R Taxable

Here are some unique ways how you could make the most use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes as well as seasonal decorations, to embellish your living areas.

2. Education

- Print worksheets that are free to help reinforce your learning at home for the classroom.

3. Event Planning

- Invitations, banners and decorations for special occasions like birthdays and weddings.

4. Organization

- Get organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Is Inherited 1099 R Taxable are an abundance of useful and creative resources that cater to various needs and interest. Their availability and versatility make them a great addition to every aspect of your life, both professional and personal. Explore the plethora of Is Inherited 1099 R Taxable right now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really absolutely free?

- Yes, they are! You can print and download these items for free.

-

Can I download free printables for commercial uses?

- It's contingent upon the specific terms of use. Always consult the author's guidelines before using any printables on commercial projects.

-

Are there any copyright issues with printables that are free?

- Some printables may contain restrictions on usage. Make sure you read the terms and conditions offered by the creator.

-

How can I print printables for free?

- You can print them at home with either a printer at home or in a print shop in your area for superior prints.

-

What program must I use to open printables that are free?

- Many printables are offered in the PDF format, and can be opened with free software such as Adobe Reader.

Forma 1099 Para Imprimir 2023 Printable Forms Free Online

FPPA 1099R Forms

Check more sample of Is Inherited 1099 R Taxable below

Ein Satz Schild Mechanismus Form 1099 R Box 7 Codes Sackgasse

Seven Form 1099 R Mistakes To Avoid Retirement Daily On TheStreet

Entering Editing Data Form 1099 R

Irs Gov Form Ssa 1099 Universal Network Printable Form 2021

What Income Is Taxable When Self Employed 1099 misc 1099 k Taxes In

1099 R Taxable Amount Calculation

https://ttlc.intuit.com/community/taxes/discussion/...

1099 R inheritance tax treatment depends on whether it was inherited from a spouse or not You may have to pay income tax on the distribution based on the type of plan and the manner in which contributions were made by the decedent

https://www.irs.gov/instructions/i1099r

These distributions are reportable on Form 1099 R and are generally taxable in the year of the distribution except for excess deferrals under section 402 g Enter Code 8 or P in box 7 with Code B if applicable to designate the distribution and the year it is taxable

1099 R inheritance tax treatment depends on whether it was inherited from a spouse or not You may have to pay income tax on the distribution based on the type of plan and the manner in which contributions were made by the decedent

These distributions are reportable on Form 1099 R and are generally taxable in the year of the distribution except for excess deferrals under section 402 g Enter Code 8 or P in box 7 with Code B if applicable to designate the distribution and the year it is taxable

Irs Gov Form Ssa 1099 Universal Network Printable Form 2021

Seven Form 1099 R Mistakes To Avoid Retirement Daily On TheStreet

What Income Is Taxable When Self Employed 1099 misc 1099 k Taxes In

1099 R Taxable Amount Calculation

1099 R Software To Create Print E File IRS Form 1099 R

1099 SA Software To Create Print E File IRS Form 1099 SA

1099 SA Software To Create Print E File IRS Form 1099 SA

1099 Form Ohio Printable Printable World Holiday