In this day and age where screens rule our lives, the charm of tangible, printed materials hasn't diminished. If it's to aid in education, creative projects, or simply to add an extra personal touch to your area, What Is 8862 Form Used For have proven to be a valuable resource. This article will take a dive into the sphere of "What Is 8862 Form Used For," exploring what they are, how to locate them, and ways they can help you improve many aspects of your life.

Get Latest What Is 8862 Form Used For Below

What Is 8862 Form Used For

What Is 8862 Form Used For -

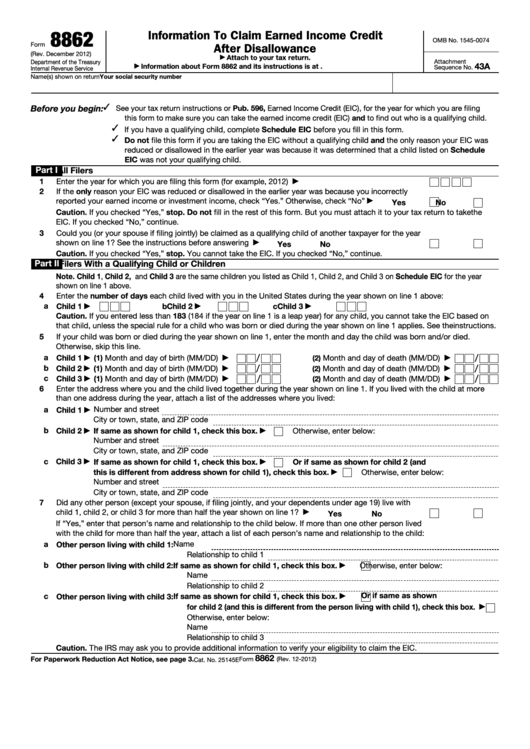

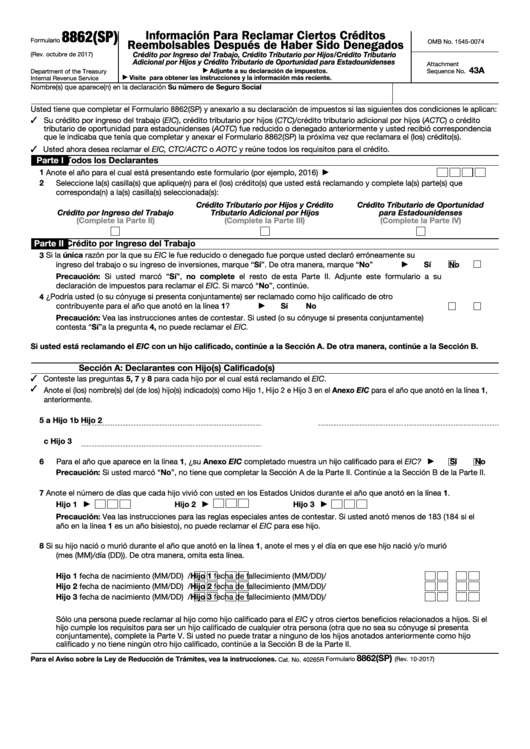

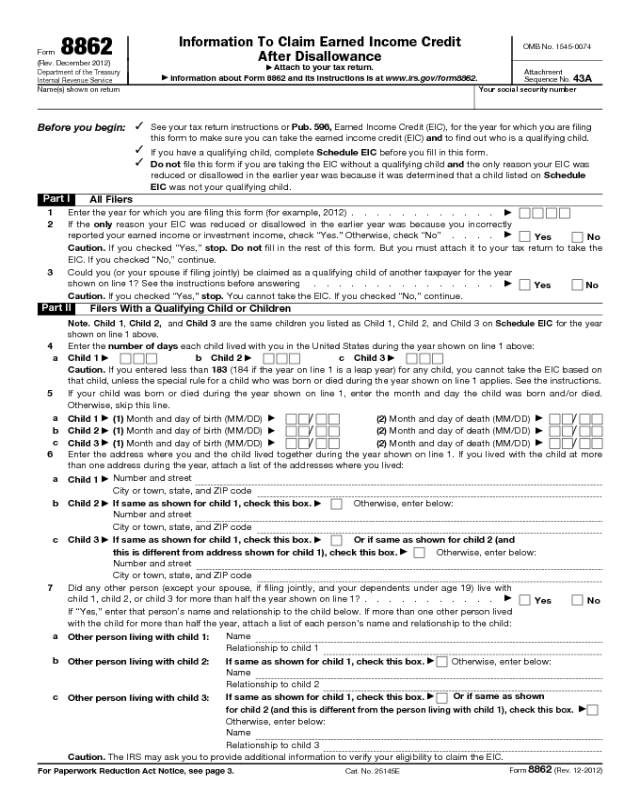

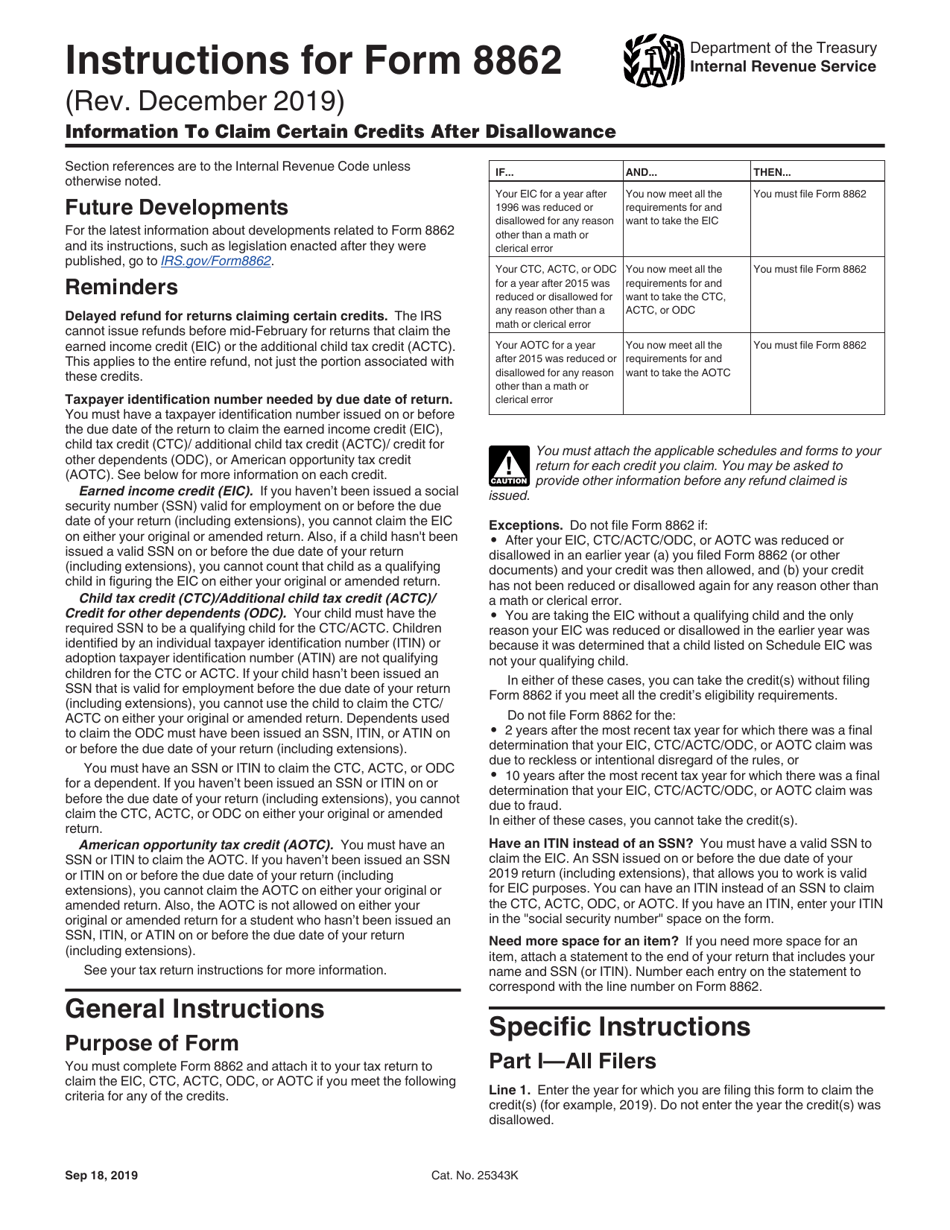

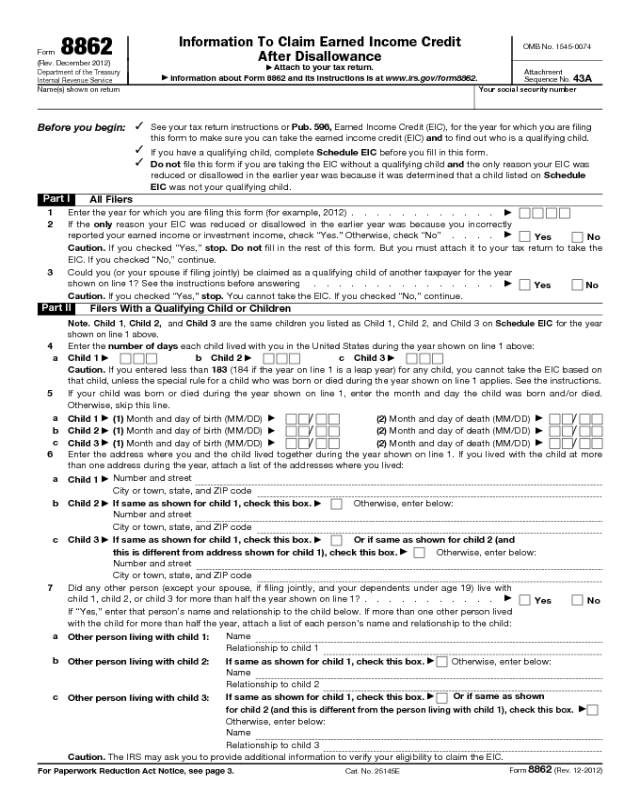

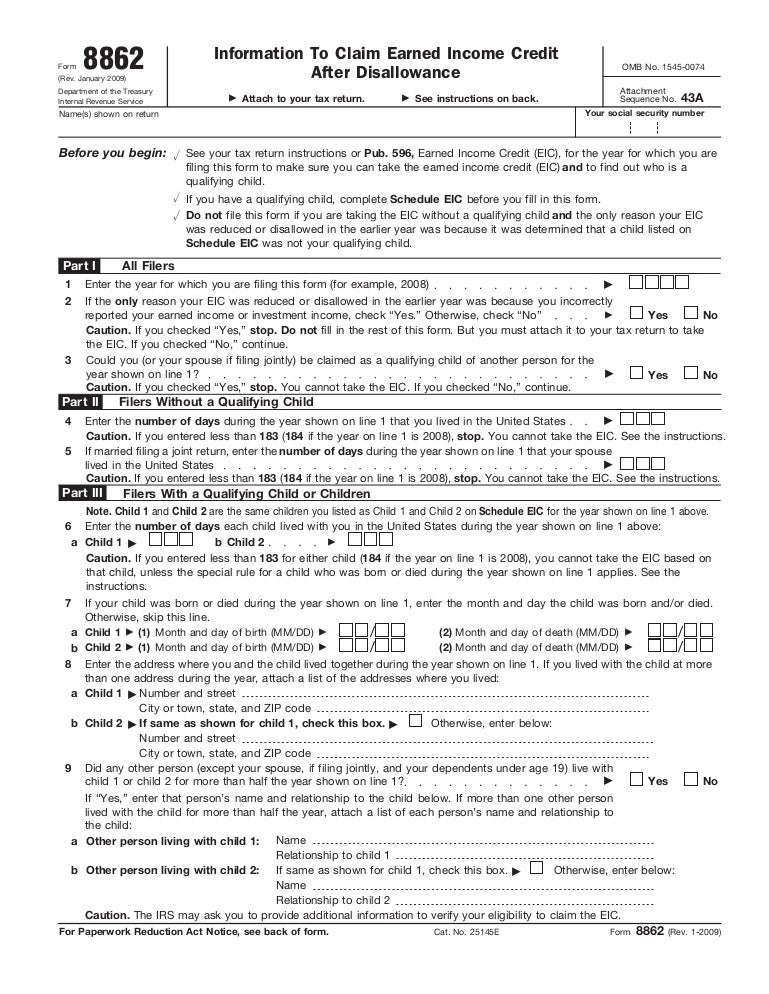

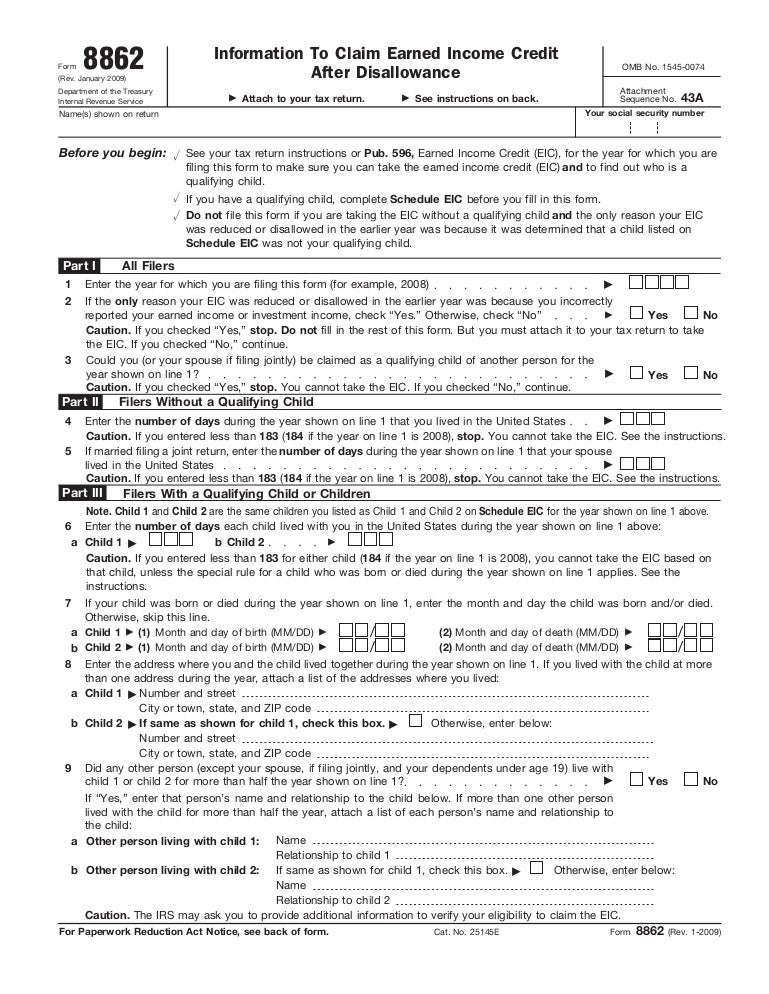

IRS Form 8862 is used by taxpayers to claim certain refundable credits after the IRS previously disallowed them This includes the Earned Income Tax Credit EITC Child

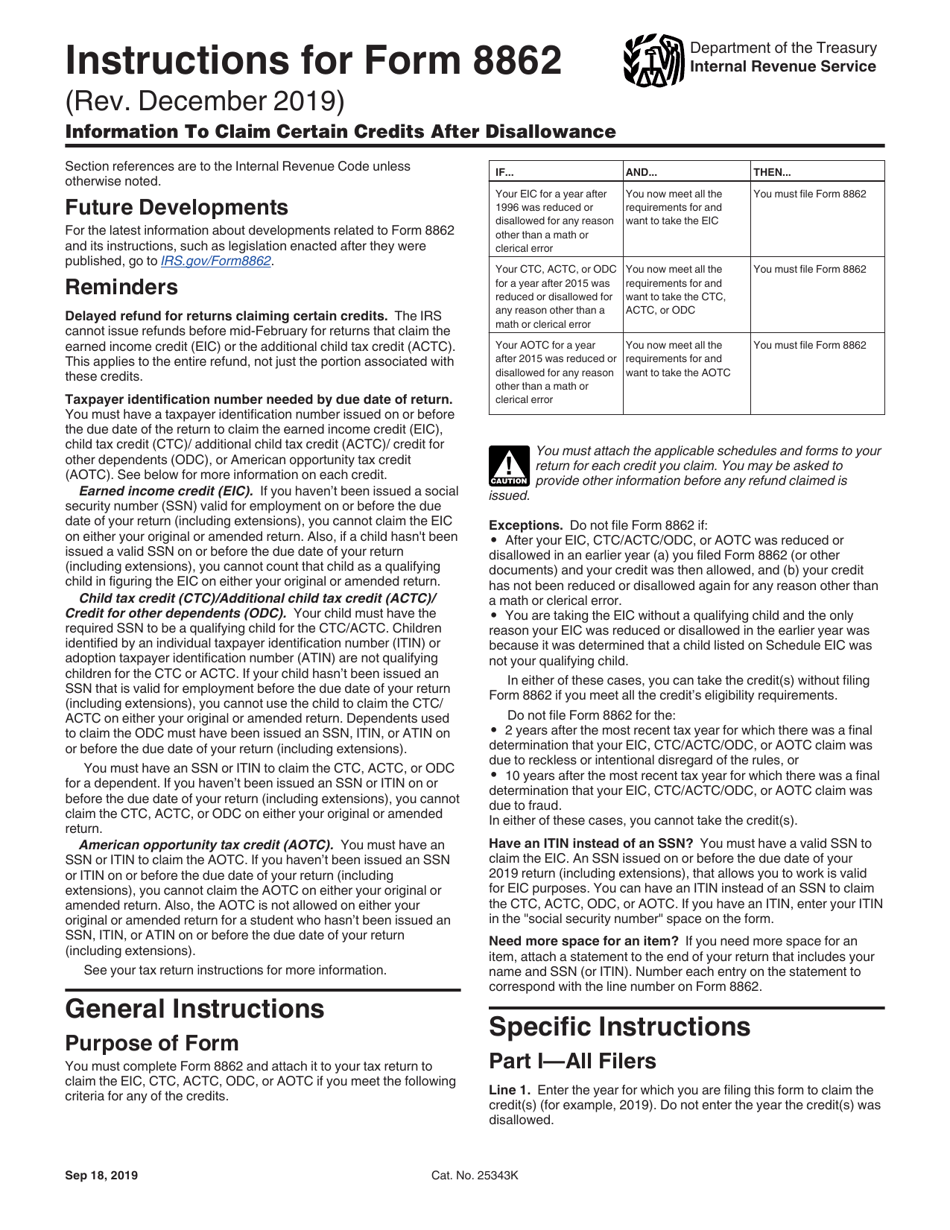

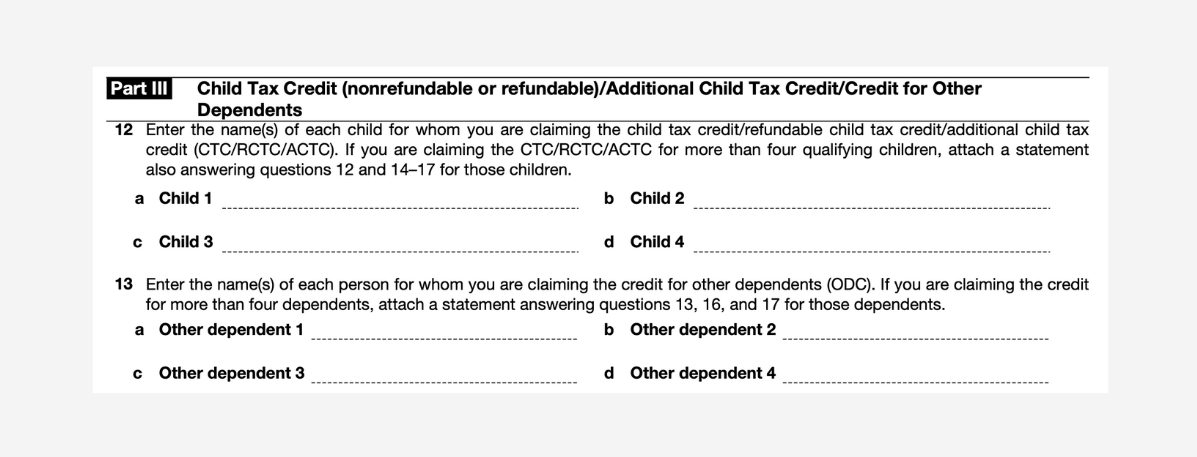

You must complete Form 8862 and attach it to your tax return to claim the EIC CTC RCTC ACTC ODC or AOTC if you meet the following criteria for any of the credits

The What Is 8862 Form Used For are a huge range of downloadable, printable materials online, at no cost. They are available in numerous designs, including worksheets coloring pages, templates and many more. The appealingness of What Is 8862 Form Used For lies in their versatility as well as accessibility.

More of What Is 8862 Form Used For

Irs Form 8862 Printable TUTORE ORG Master Of Documents

Irs Form 8862 Printable TUTORE ORG Master Of Documents

The purpose of Form 8862 Information to Claim Certain Credits After Disallowance is to allow taxpayers to reclaim tax credits that were reduced or disallowed on their previous tax returns

What s the Purpose of Form 8862 The primary purpose of Form 8862 is to help taxpayers reclaim these credits if they meet the following criteria Their claimed credit was

What Is 8862 Form Used For have gained immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the need to purchase physical copies or costly software.

-

The ability to customize: You can tailor printed materials to meet your requirements whether you're designing invitations or arranging your schedule or even decorating your home.

-

Educational value: Downloads of educational content for free can be used by students of all ages. This makes them an invaluable source for educators and parents.

-

The convenience of Instant access to a plethora of designs and templates can save you time and energy.

Where to Find more What Is 8862 Form Used For

Fillable Form 8862 Information To Claim Earned Income Credit After

Fillable Form 8862 Information To Claim Earned Income Credit After

Form 8862 is an important document that you need to file if you want to claim the EITC or the ACTC after being denied by the IRS in a previous year By following the

What is IRS Form 8862 IRS Form 8862 Information to Claim Certain Credits After Disallowance is the federal form that a taxpayer may use to claim certain tax credits that were previously disallowed

Now that we've ignited your interest in What Is 8862 Form Used For and other printables, let's discover where they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of What Is 8862 Form Used For for various purposes.

- Explore categories such as decorating your home, education, the arts, and more.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets as well as flashcards and other learning materials.

- It is ideal for teachers, parents or students in search of additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates free of charge.

- The blogs covered cover a wide array of topics, ranging everything from DIY projects to planning a party.

Maximizing What Is 8862 Form Used For

Here are some unique ways that you can make use use of What Is 8862 Form Used For:

1. Home Decor

- Print and frame beautiful artwork, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Print free worksheets to help reinforce your learning at home as well as in the class.

3. Event Planning

- Invitations, banners as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Get organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

What Is 8862 Form Used For are a treasure trove filled with creative and practical information designed to meet a range of needs and hobbies. Their accessibility and flexibility make them a great addition to both personal and professional life. Explore the many options of What Is 8862 Form Used For today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free free?

- Yes, they are! You can download and print these files for free.

-

Does it allow me to use free printables to make commercial products?

- It's dependent on the particular conditions of use. Always check the creator's guidelines prior to utilizing the templates for commercial projects.

-

Are there any copyright violations with printables that are free?

- Certain printables could be restricted on their use. Always read the terms and condition of use as provided by the creator.

-

How can I print What Is 8862 Form Used For?

- Print them at home with an printer, or go to an in-store print shop to get top quality prints.

-

What program is required to open printables free of charge?

- Many printables are offered with PDF formats, which can be opened using free software such as Adobe Reader.

Top 14 Form 8862 Templates Free To Download In PDF Format

What Does Form 8862 Look Like Fill Online Printable Fillable Blank

Check more sample of What Is 8862 Form Used For below

Fill Out Form 8862 Template Reclaim Tax Credits With Ease

8862

Top 14 Form 8862 Templates Free To Download In PDF Format

Form 8862 Edit Fill Sign Online Handypdf

Download Instructions For IRS Form 8862 Information To Claim Certain

IRS Form 8862 Diagram Quizlet

https://www.irs.gov/instructions/i8862

You must complete Form 8862 and attach it to your tax return to claim the EIC CTC RCTC ACTC ODC or AOTC if you meet the following criteria for any of the credits

https://www.thebalancemoney.com/irs-f…

IRS Form 8862 is used when a taxpayer was denied a credit like the EITC in a prior year and now wants to reclaim it Learn

You must complete Form 8862 and attach it to your tax return to claim the EIC CTC RCTC ACTC ODC or AOTC if you meet the following criteria for any of the credits

IRS Form 8862 is used when a taxpayer was denied a credit like the EITC in a prior year and now wants to reclaim it Learn

Form 8862 Edit Fill Sign Online Handypdf

8862

Download Instructions For IRS Form 8862 Information To Claim Certain

IRS Form 8862 Diagram Quizlet

8862 Form Reclaiming The Earned Income Credit PdfFiller Blog

Form 8862 Information To Claim Earned Income Credit For Disallowance

Form 8862 Information To Claim Earned Income Credit For Disallowance

Form 8862 Edit Fill Sign Online Handypdf