In this age of technology, in which screens are the norm but the value of tangible printed materials isn't diminishing. No matter whether it's for educational uses and creative work, or simply adding personal touches to your area, What Is A 8862 Form For Your Taxes have proven to be a valuable source. We'll dive into the world of "What Is A 8862 Form For Your Taxes," exploring the different types of printables, where you can find them, and the ways that they can benefit different aspects of your lives.

Get Latest What Is A 8862 Form For Your Taxes Below

What Is A 8862 Form For Your Taxes

What Is A 8862 Form For Your Taxes -

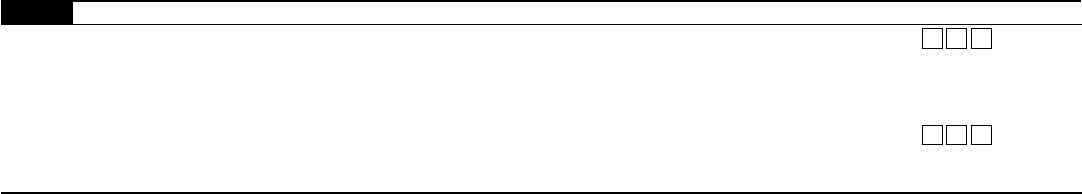

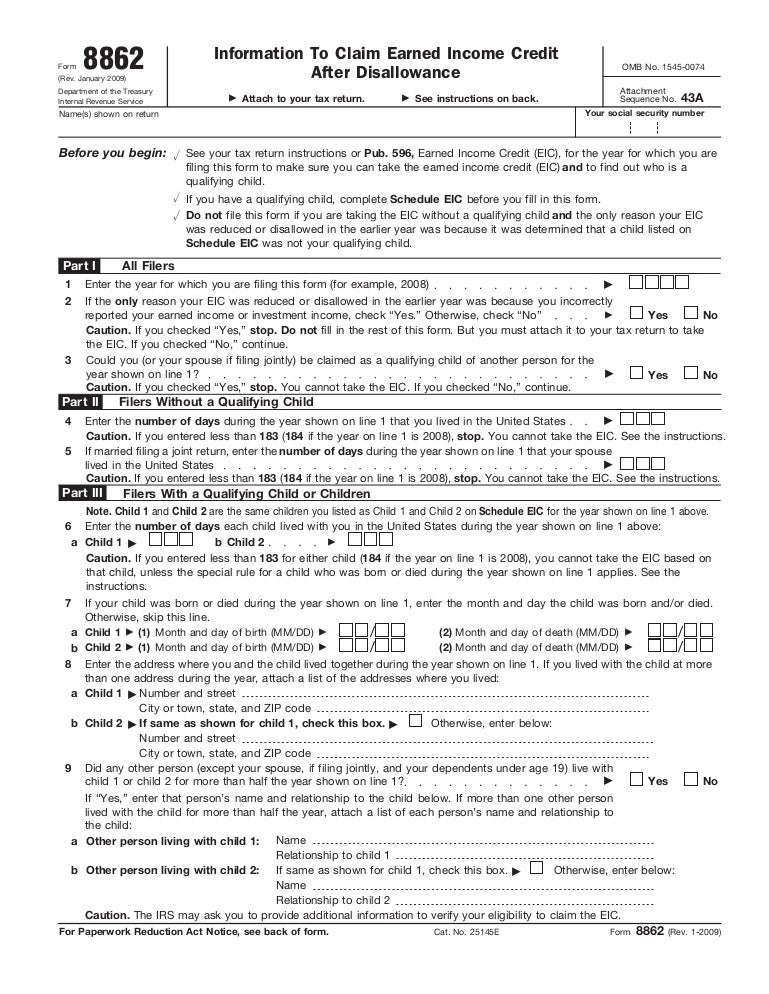

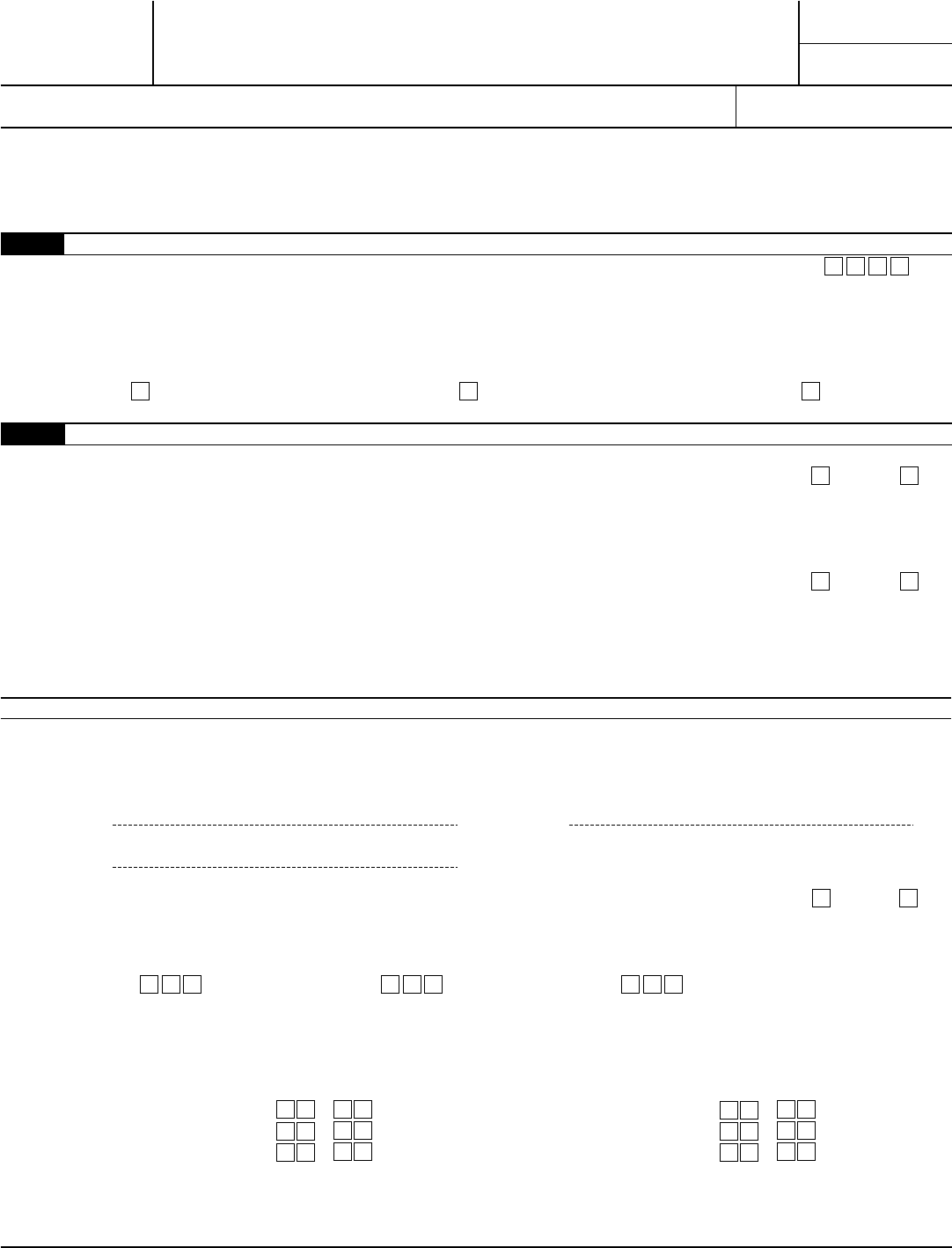

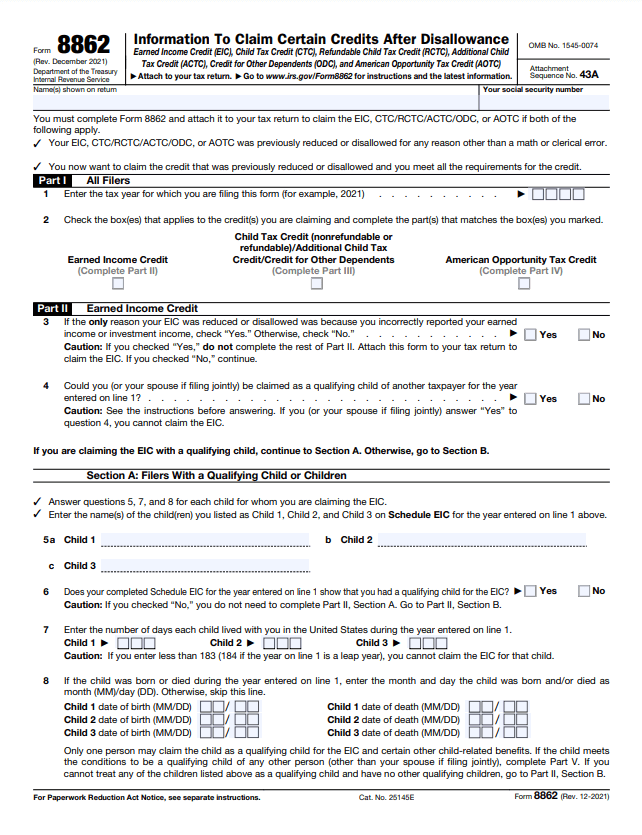

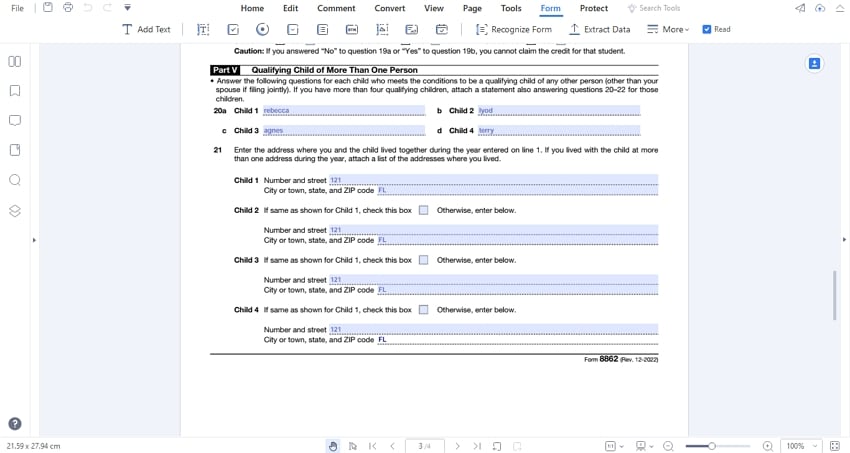

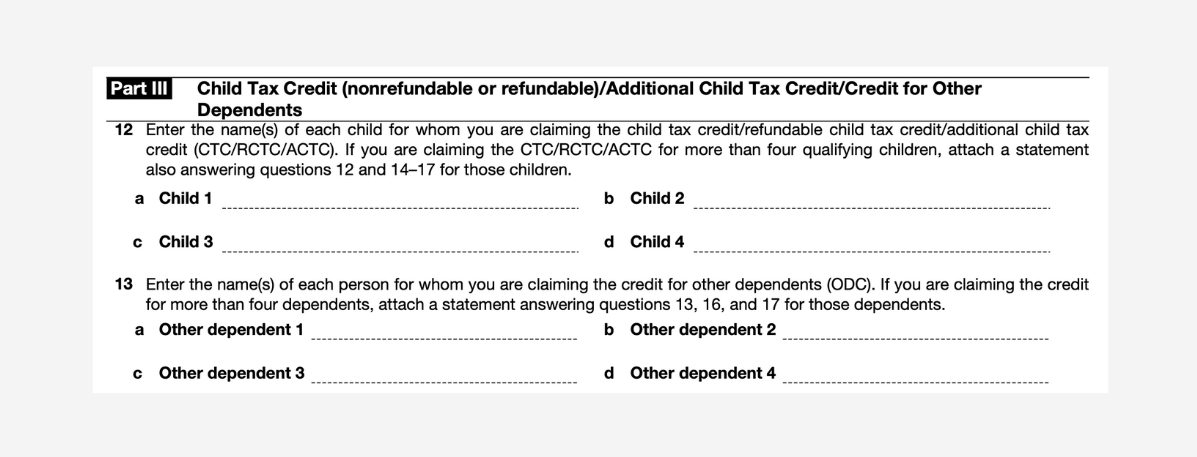

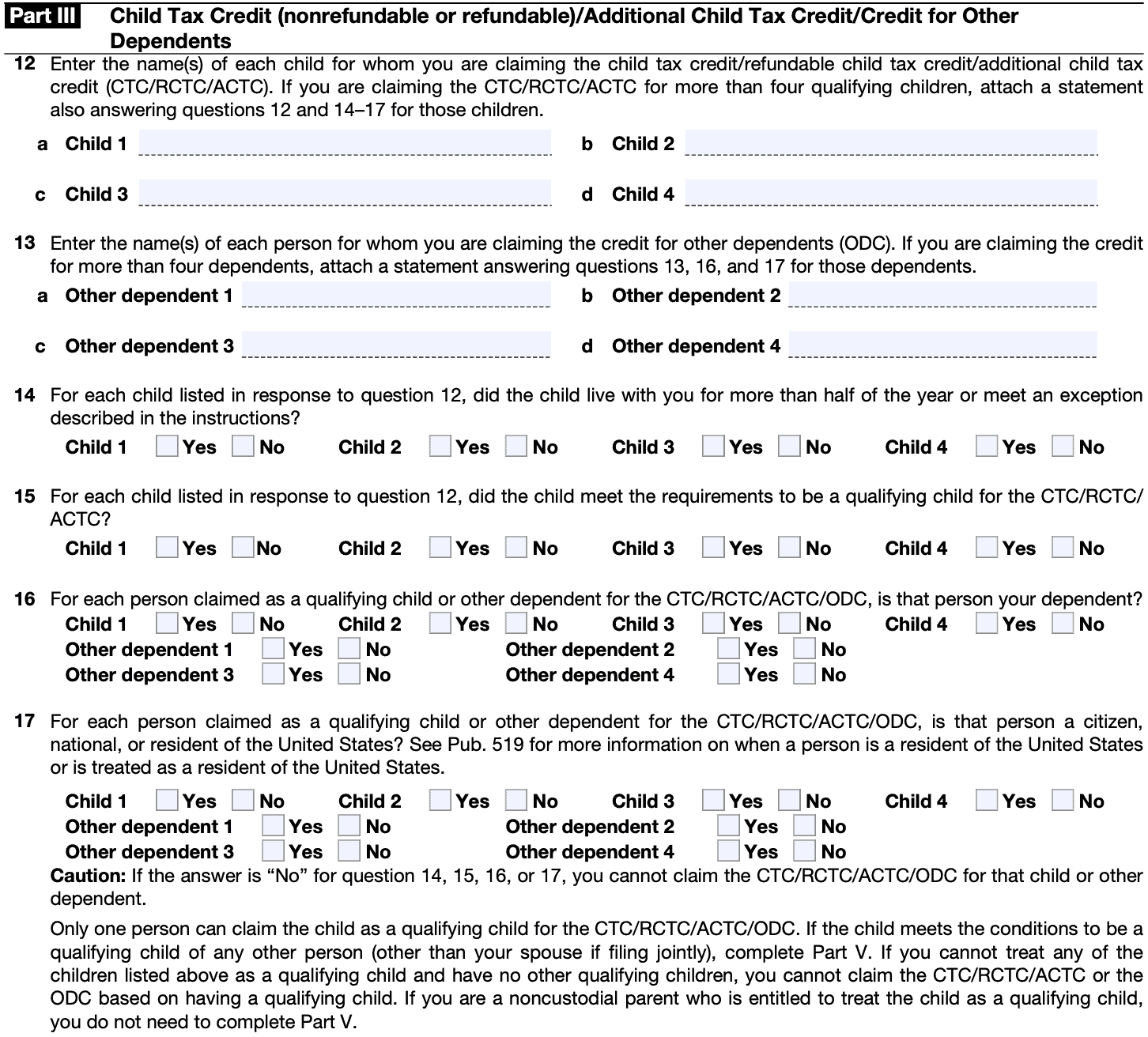

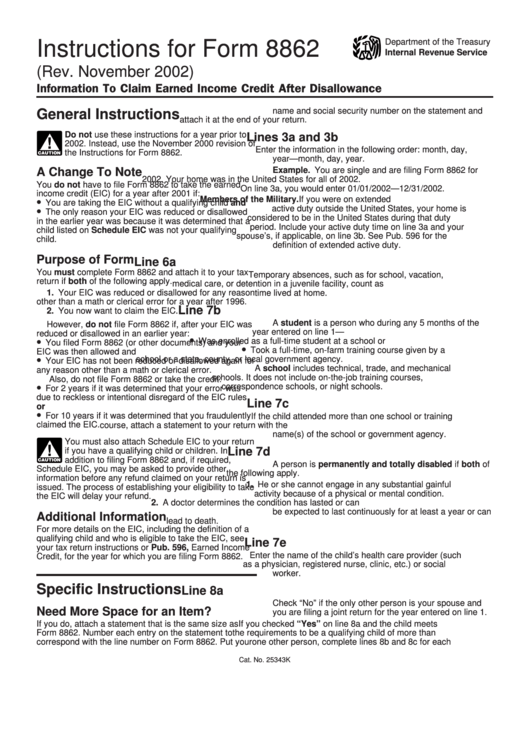

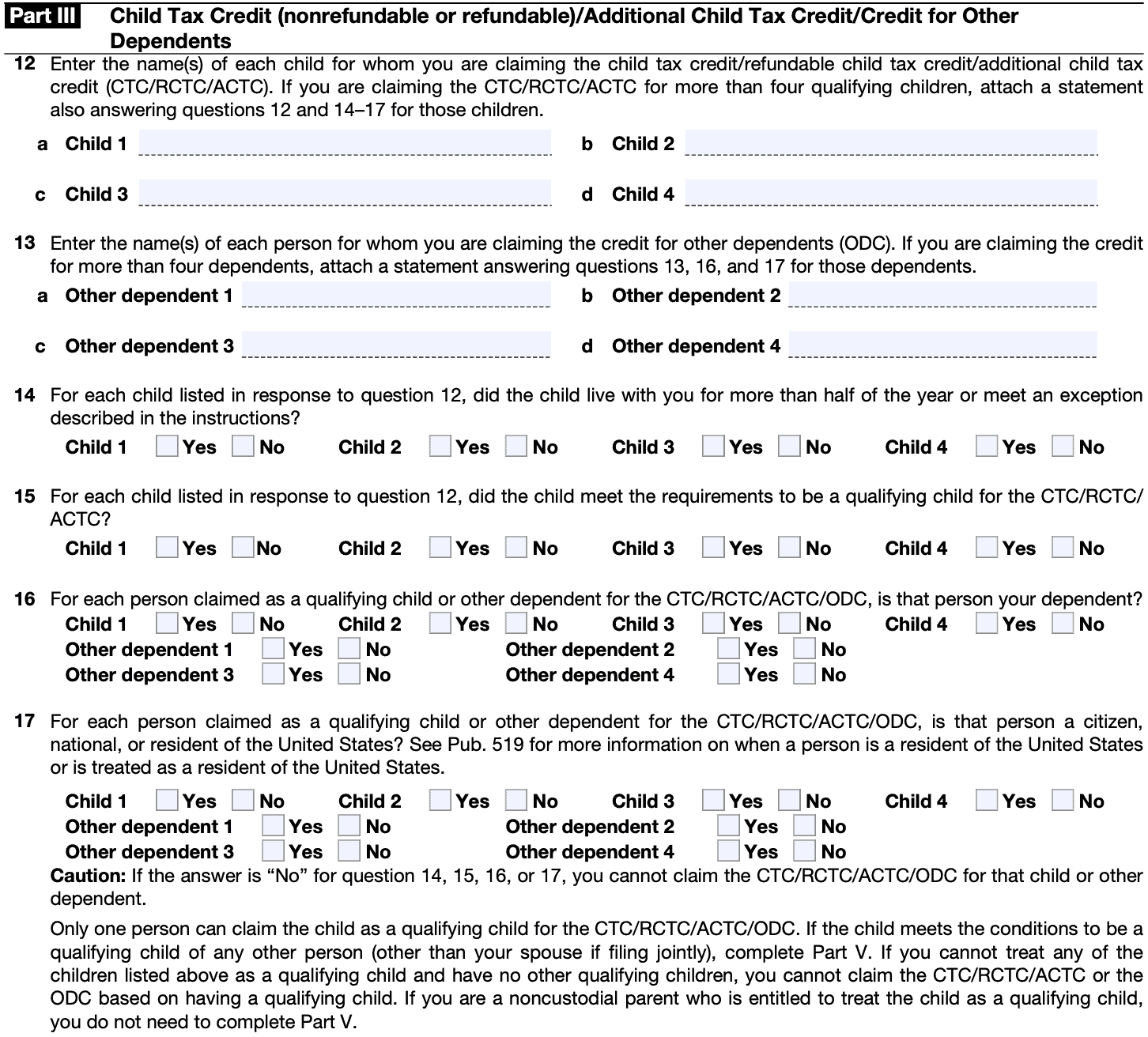

IRS Form 8862 Information to Claim Certain Credits After Disallowance can give you another chance to claim the tax credit you rightfully deserve You can use this form to file for the EITC and

Taxpayers complete Form 8862 and attach it to their tax return if Their earned income credit EIC child tax credit CTC additional child tax credit ACTC credit for other

What Is A 8862 Form For Your Taxes offer a wide array of printable material that is available online at no cost. They are available in a variety of formats, such as worksheets, templates, coloring pages and more. The beauty of What Is A 8862 Form For Your Taxes is their flexibility and accessibility.

More of What Is A 8862 Form For Your Taxes

Form 8862 Edit Fill Sign Online Handypdf

Form 8862 Edit Fill Sign Online Handypdf

What is Form 8960 by TurboTax 1426 Updated December 12 2023 What s Schedule 8812 by TurboTax 3461 Updated July 23 2024 Where do I find Form 8606

Form 8862 titled Information To Claim Certain Credits After Disallowance is an official Internal Revenue Service IRS document used to reclaim tax credits that were

What Is A 8862 Form For Your Taxes have gained a lot of popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Individualization This allows you to modify printing templates to your own specific requirements, whether it's designing invitations and schedules, or decorating your home.

-

Educational Value: Printing educational materials for no cost can be used by students from all ages, making them a vital tool for parents and educators.

-

Accessibility: Fast access a myriad of designs as well as templates helps save time and effort.

Where to Find more What Is A 8862 Form For Your Taxes

Form 8862 Information To Claim Earned Income Credit For Disallowance

Form 8862 Information To Claim Earned Income Credit For Disallowance

Tax form 8862 is an IRS attachment that must be filed to claim the Earned Income Credit the Child Tax Credit Additional Child Tax Credit Credit for Other

The 8862 form is a crucial IRS document used by taxpayers to reclaim eligibility for certain tax credits that have been previously disallowed These credits often include the Earned

Now that we've ignited your curiosity about What Is A 8862 Form For Your Taxes Let's take a look at where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection and What Is A 8862 Form For Your Taxes for a variety motives.

- Explore categories like interior decor, education, management, and craft.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing as well as flashcards and other learning materials.

- Perfect for teachers, parents, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers share their imaginative designs with templates and designs for free.

- The blogs covered cover a wide selection of subjects, including DIY projects to party planning.

Maximizing What Is A 8862 Form For Your Taxes

Here are some innovative ways that you can make use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print out free worksheets and activities to build your knowledge at home, or even in the classroom.

3. Event Planning

- Design invitations for banners, invitations and decorations for special events like birthdays and weddings.

4. Organization

- Stay organized with printable planners, to-do lists, and meal planners.

Conclusion

What Is A 8862 Form For Your Taxes are an abundance with useful and creative ideas that satisfy a wide range of requirements and interests. Their accessibility and versatility make them a wonderful addition to both personal and professional life. Explore the wide world of What Is A 8862 Form For Your Taxes today to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are What Is A 8862 Form For Your Taxes really free?

- Yes, they are! You can print and download these files for free.

-

Can I utilize free printables for commercial use?

- It depends on the specific conditions of use. Always read the guidelines of the creator prior to using the printables in commercial projects.

-

Are there any copyright violations with What Is A 8862 Form For Your Taxes?

- Some printables could have limitations on their use. Make sure you read the terms and conditions set forth by the designer.

-

How do I print What Is A 8862 Form For Your Taxes?

- You can print them at home using any printer or head to a print shop in your area for premium prints.

-

What software must I use to open printables free of charge?

- The majority of printables are with PDF formats, which is open with no cost software, such as Adobe Reader.

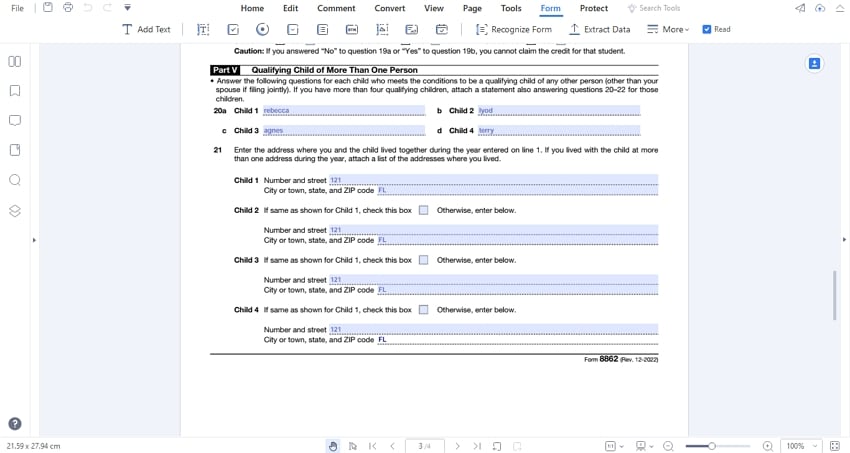

Form 8862 Rev December 2012 Edit Fill Sign Online Handypdf

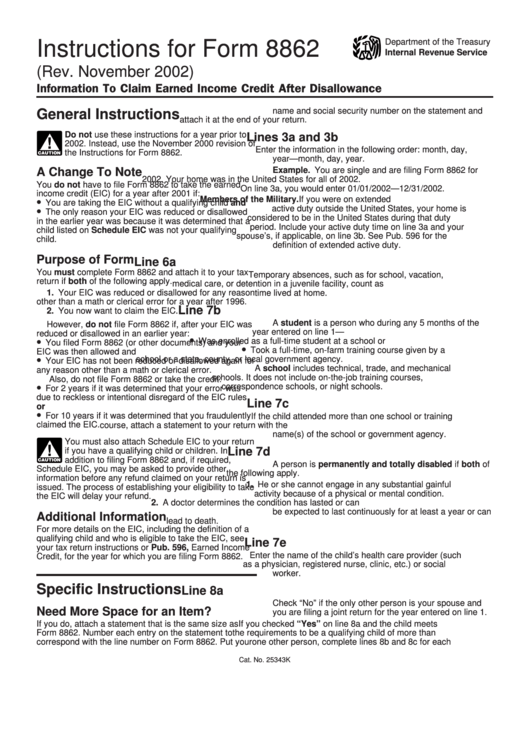

Download Instructions For IRS Form 8862 Information To Claim Certain

Check more sample of What Is A 8862 Form For Your Taxes below

What Is An 8862 Tax Form SuperMoney

Instructions On Filling Out IRS Form 8862

8862 Form Reclaiming The Earned Income Credit PdfFiller Blog

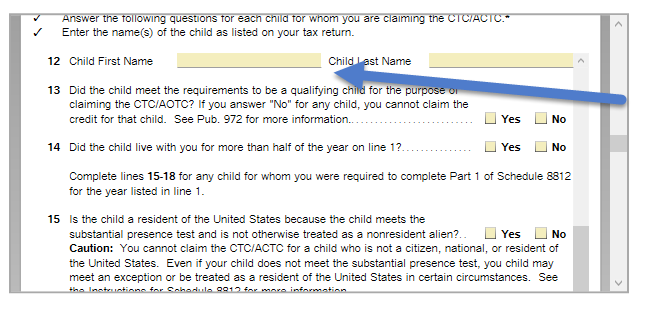

IRS Form 8862 Instructions

How To Claim An Earned Income Credit By Electronically Filing IRS Form 8862

Instructions For Form 8862 Information To Claim Earned Income Credit

https://www.irs.gov/forms-pubs/about-form-8862

Taxpayers complete Form 8862 and attach it to their tax return if Their earned income credit EIC child tax credit CTC additional child tax credit ACTC credit for other

https://www.thebalancemoney.com/irs-f…

IRS Form 8862 is used when a taxpayer was denied a credit like the EITC in a prior year and now wants to reclaim it Learn how Form 8862 works and how to file it

Taxpayers complete Form 8862 and attach it to their tax return if Their earned income credit EIC child tax credit CTC additional child tax credit ACTC credit for other

IRS Form 8862 is used when a taxpayer was denied a credit like the EITC in a prior year and now wants to reclaim it Learn how Form 8862 works and how to file it

IRS Form 8862 Instructions

Instructions On Filling Out IRS Form 8862

How To Claim An Earned Income Credit By Electronically Filing IRS Form 8862

Instructions For Form 8862 Information To Claim Earned Income Credit

2020 Form IRS 8867 Fill Online Printable Fillable Blank PdfFiller

IRS Form 8862 Diagram Quizlet

IRS Form 8862 Diagram Quizlet

How Do I Add Form 8862 TurboTax Support