In this age of technology, in which screens are the norm The appeal of tangible printed materials hasn't faded away. It doesn't matter if it's for educational reasons project ideas, artistic or simply to add an element of personalization to your area, Is 1099 K Income Taxable have become a valuable resource. In this article, we'll take a dive to the depths of "Is 1099 K Income Taxable," exploring the benefits of them, where to find them, and what they can do to improve different aspects of your lives.

Get Latest Is 1099 K Income Taxable Below

Is 1099 K Income Taxable

Is 1099 K Income Taxable - Is 1099 K Income Taxable, How Is 1099 K Income Taxed, Does 1099 K Count As Income, Does 1099 Count As Income, Do I Have To Report 1099 K Income

What is IRS Form 1099 K How Does Form 1099 K Impact eBay Sellers Is the eBay reporting threshold changing in 2025 Will I get an eBay 1099 K for multiple accounts Determining Taxable Income for eBay

Myth If taxpayers didn t receive a Form 1099 K they don t have to report income Fact According to federal law all income is taxable unless it is specifically excluded by tax law Taxpayers should report any profits from selling goods or services regardless of if they receive a Form 1099 K

Is 1099 K Income Taxable provide a diverse assortment of printable documents that can be downloaded online at no cost. These resources come in various forms, like worksheets coloring pages, templates and much more. The value of Is 1099 K Income Taxable is their flexibility and accessibility.

More of Is 1099 K Income Taxable

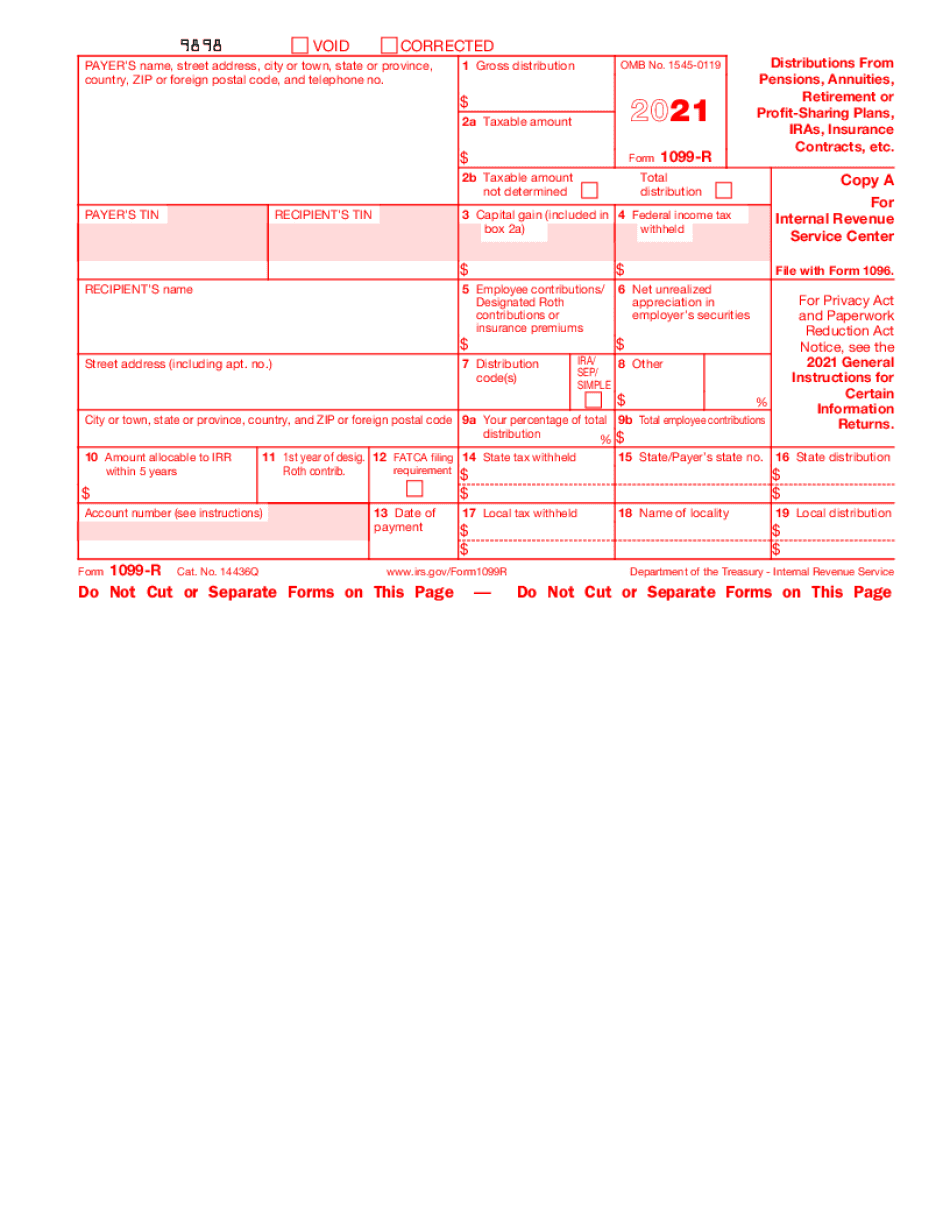

1099 r Taxable Amount Calculation Fill Online Printable Fillable Blank

1099 r Taxable Amount Calculation Fill Online Printable Fillable Blank

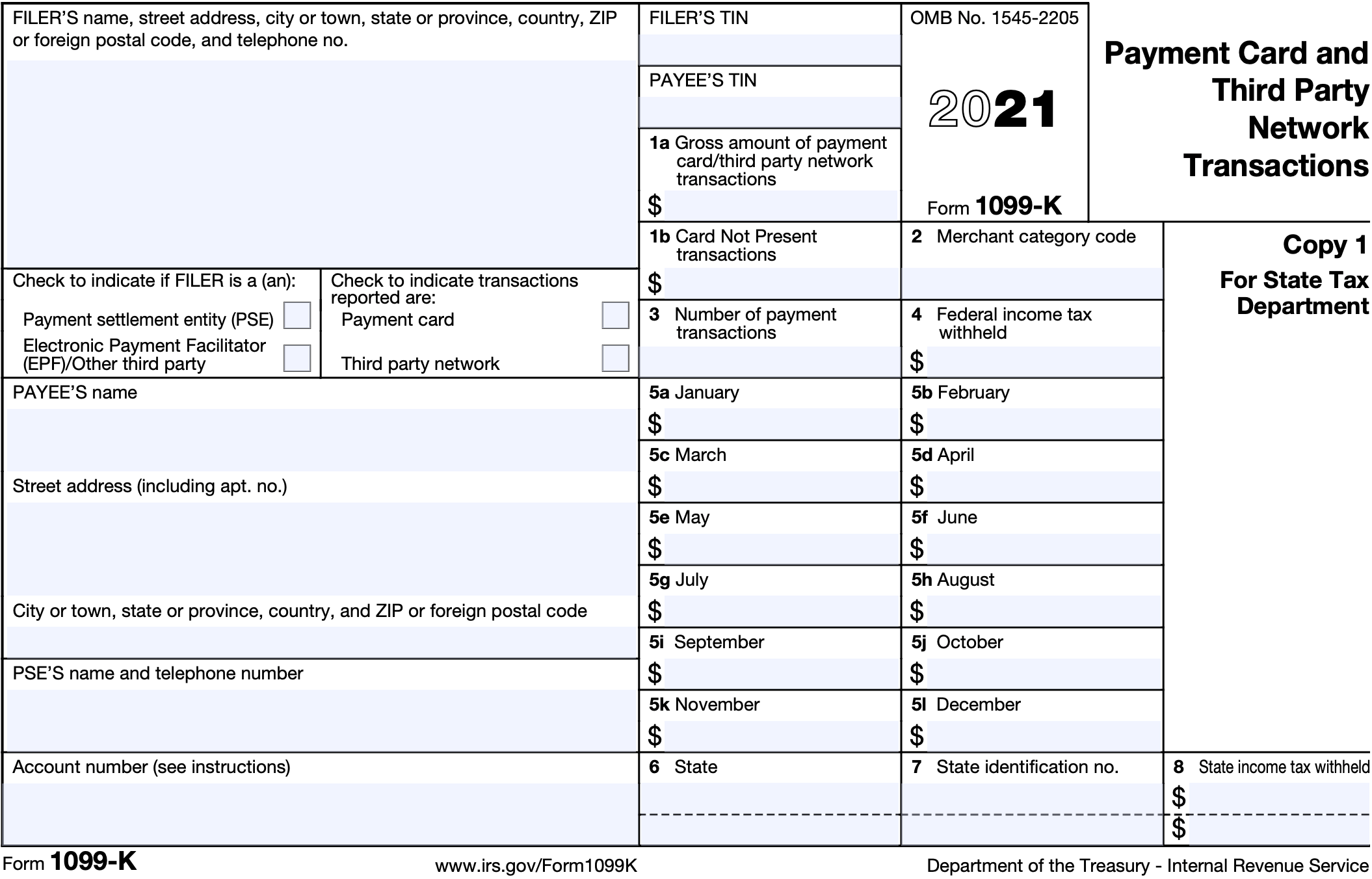

Form 1099 K is the IRS form that taxpayers receive to report certain payment transactions If you re self employed or an independent contractor you report 1099 K income on Schedule C of your

Form 1099 K Payment Card and Third Party Network Transactions is an IRS form used to report credit debit card transactions and third party network payments The IRS planned to implement changes to the 1099 K

Is 1099 K Income Taxable have risen to immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the need to buy physical copies or costly software.

-

Personalization It is possible to tailor the templates to meet your individual needs whether it's making invitations to organize your schedule or even decorating your house.

-

Education Value Printing educational materials for no cost offer a wide range of educational content for learners of all ages. This makes them an essential resource for educators and parents.

-

Accessibility: immediate access numerous designs and templates cuts down on time and efforts.

Where to Find more Is 1099 K Income Taxable

Understanding Your Tax Forms 2016 1099 K Payment Card And Third Party

Understanding Your Tax Forms 2016 1099 K Payment Card And Third Party

How do I know if 1099 K amounts are taxable No changes have been made to the taxability of income received through a third party organization These organizations should only issue a 1099 K if you used them to receive

In 2023 a 1099 K is issued to taxpayers if payments total at least 20 000 over at least 200 transactions In 2024 the threshold drops to 5 000 and there is no transaction limit Transactions are only taxable if they result in a profit

In the event that we've stirred your interest in printables for free Let's find out where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of Is 1099 K Income Taxable for various applications.

- Explore categories such as the home, decor, organization, and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets including flashcards, learning tools.

- It is ideal for teachers, parents and students looking for additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs or templates for download.

- The blogs are a vast spectrum of interests, that range from DIY projects to planning a party.

Maximizing Is 1099 K Income Taxable

Here are some ideas how you could make the most of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Use free printable worksheets for teaching at-home for the classroom.

3. Event Planning

- Design invitations, banners and decorations for special events such as weddings and birthdays.

4. Organization

- Be organized by using printable calendars, to-do lists, and meal planners.

Conclusion

Is 1099 K Income Taxable are an abundance of creative and practical resources that satisfy a wide range of requirements and interests. Their availability and versatility make them a great addition to your professional and personal life. Explore the vast collection of Is 1099 K Income Taxable and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free gratis?

- Yes they are! You can print and download these documents for free.

-

Can I use free printables in commercial projects?

- It is contingent on the specific conditions of use. Always review the terms of use for the creator prior to using the printables in commercial projects.

-

Do you have any copyright concerns with Is 1099 K Income Taxable?

- Some printables may come with restrictions on their use. Be sure to check the terms and condition of use as provided by the designer.

-

How do I print Is 1099 K Income Taxable?

- Print them at home using printing equipment or visit an in-store print shop to get high-quality prints.

-

What program do I need to run printables that are free?

- Most printables come in the format of PDF, which is open with no cost software such as Adobe Reader.

How Form 1099 K Affects Your E Commerce Business Digital

Payment Card And Third Party Network Transactions 1099 K Crippen

Check more sample of Is 1099 K Income Taxable below

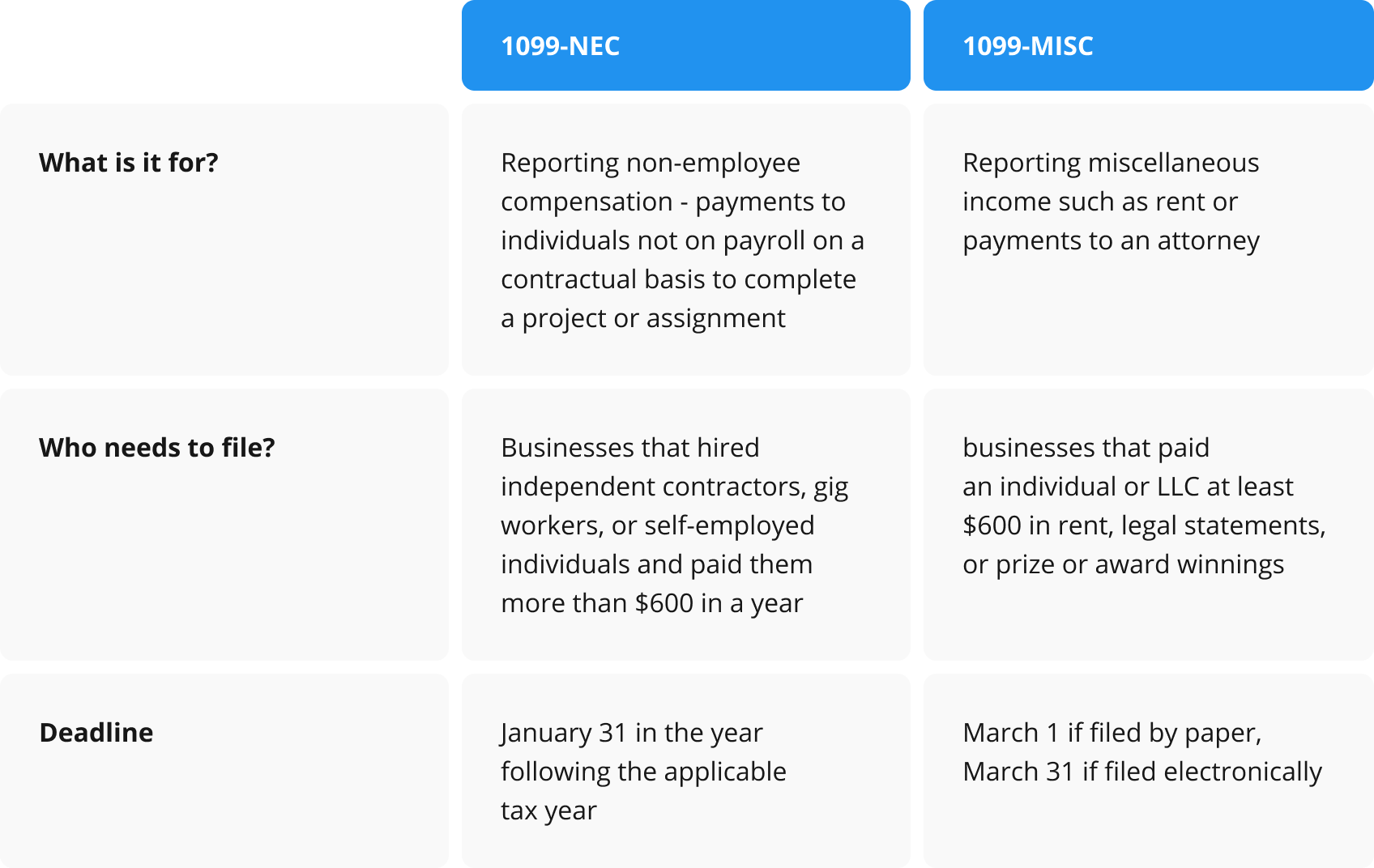

Form 1099 MISC How To Report Your Miscellaneous Income PdfFiller Blog

Free Printable 1099 Free Printable Templates

Types Of 1099 Form 2023 Printable Forms Free Online

:max_bytes(150000):strip_icc()/1099-R2022-2372bb9e77514c4a8af4bcc393b6cd36.jpeg)

Clarifications And Complexities Of The New 1099 K Reporting

Printable Form Ssa 1099 Printable Form 2024

Schwab MoneyWise Understanding Form 1099

https://www.irs.gov/newsroom/irs-never-mind-the...

Myth If taxpayers didn t receive a Form 1099 K they don t have to report income Fact According to federal law all income is taxable unless it is specifically excluded by tax law Taxpayers should report any profits from selling goods or services regardless of if they receive a Form 1099 K

https://www.irs.gov/newsroom/form-1099-k-faqs-general-information

All income no matter the amount is taxable unless the tax law says it isn t even if you don t get a Form 1099 K Income also includes amounts not reported on forms such as payments you receive in cash property or services

Myth If taxpayers didn t receive a Form 1099 K they don t have to report income Fact According to federal law all income is taxable unless it is specifically excluded by tax law Taxpayers should report any profits from selling goods or services regardless of if they receive a Form 1099 K

All income no matter the amount is taxable unless the tax law says it isn t even if you don t get a Form 1099 K Income also includes amounts not reported on forms such as payments you receive in cash property or services

Clarifications And Complexities Of The New 1099 K Reporting

Free Printable 1099 Free Printable Templates

Printable Form Ssa 1099 Printable Form 2024

Schwab MoneyWise Understanding Form 1099

What Is A 1099 K Tax Form

Form 1099 MISC For Independent Consultants 6 Step Guide

Form 1099 MISC For Independent Consultants 6 Step Guide

1099 K Software To Create Print And E File Form 1099 K Irs Forms