In the digital age, with screens dominating our lives, the charm of tangible printed items hasn't gone away. In the case of educational materials and creative work, or just adding the personal touch to your space, Is 1099 Q Taxable are a great source. This article will dive through the vast world of "Is 1099 Q Taxable," exploring what they are, how they are, and how they can be used to enhance different aspects of your lives.

Get Latest Is 1099 Q Taxable Below

Is 1099 Q Taxable

Is 1099 Q Taxable - Is 1099 Q Taxable, Is 1099 Q Distribution Taxable, Is 1099-r Code Q Taxable, Is Box 2 On 1099-q Taxable, Is 1099-r Distribution Code Q Taxable, Do I Have To Pay Taxes On 1099-q

Information about Form 1099 Q Payments from Qualified Education Programs including recent updates related forms and instructions on how to file File Form 1099 Q if you made a distribution from a qualified tuition program QTP

Form 1099 Q Payments From Qualified Education Programs is an Internal Revenue Service IRS tax form sent to individuals who receive distributions from a Coverdell education savings

Is 1099 Q Taxable include a broad selection of printable and downloadable materials that are accessible online for free cost. They are available in numerous formats, such as worksheets, coloring pages, templates and much more. The great thing about Is 1099 Q Taxable is their flexibility and accessibility.

More of Is 1099 Q Taxable

1090 Form 2023 Printable Forms Free Online

:max_bytes(150000):strip_icc()/1099-R2022-2372bb9e77514c4a8af4bcc393b6cd36.jpeg)

1090 Form 2023 Printable Forms Free Online

Objectives Recognize qualified higher educational expenses for 529 plans Properly calculate the tax free and taxable portions of distributions from a 529 plan Properly report the distributions from a 529 plan Identify ways for a client to utilize 529 funds

Form 1099 Q recipients should ensure they have used their distributed amounts for qualified purposes Otherwise any distribution amount reported on Form 1099 Q in excess of the amount used for qualified purposes may be taxable

Is 1099 Q Taxable have risen to immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or costly software.

-

Individualization The Customization feature lets you tailor printing templates to your own specific requirements for invitations, whether that's creating them making your schedule, or even decorating your home.

-

Education Value The free educational worksheets can be used by students of all ages. This makes them a valuable instrument for parents and teachers.

-

An easy way to access HTML0: Instant access to a variety of designs and templates is time-saving and saves effort.

Where to Find more Is 1099 Q Taxable

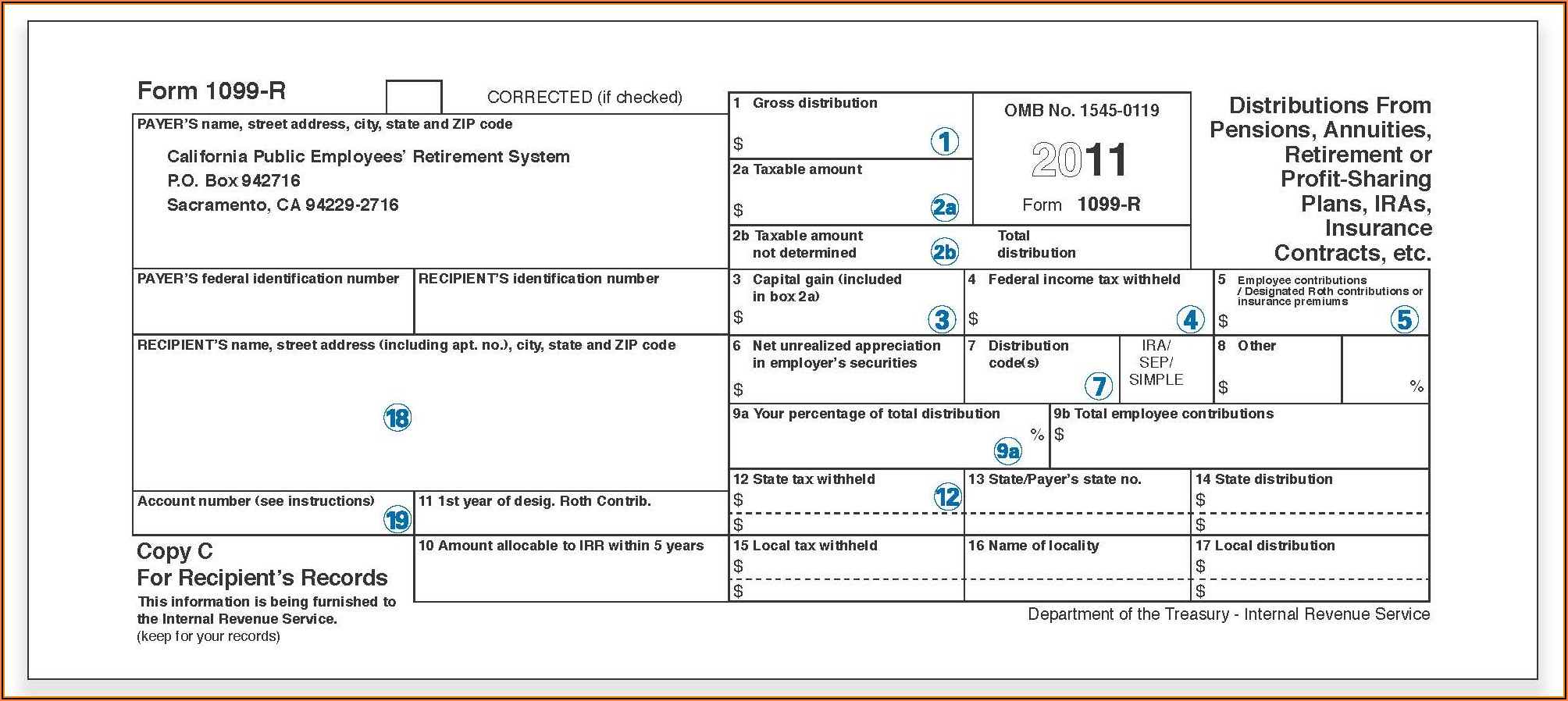

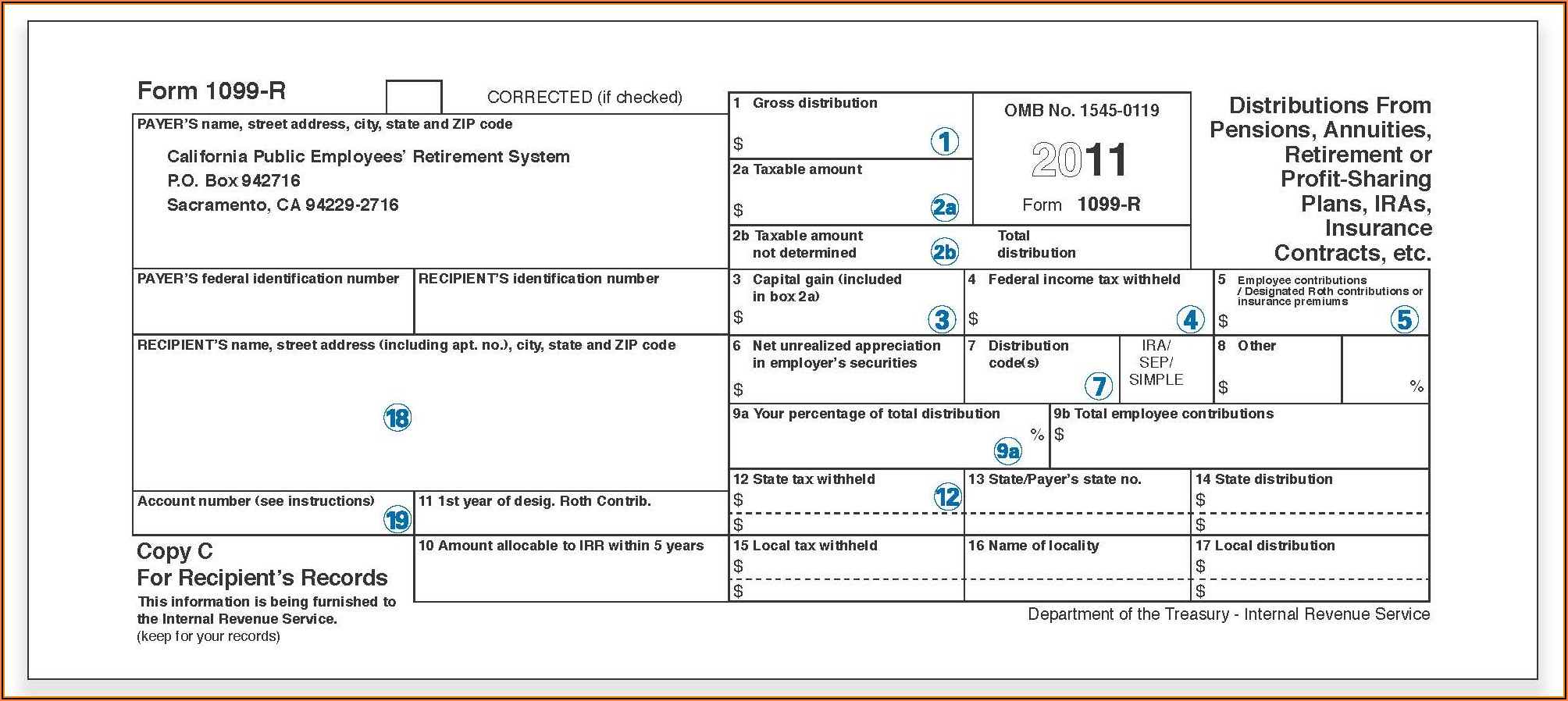

Form 1099 R Instructions Information Community Tax

Form 1099 R Instructions Information Community Tax

When the Form 1099 Q is issued to the 529 plan beneficiary any taxable amount of the distribution will be reported on the designated beneficiary s income tax return This typically results in a lower tax obligation than if the Form 1099 Q is issued to the parent or 529 plan account owner

Form 1099 Q reports total withdrawals from qualified tuition programs QTPs like 529 plans or Coverdell educational savings accounts Knowing what to do with this form can help you avoid paying taxes and penalties on withdrawals that could be

We've now piqued your curiosity about Is 1099 Q Taxable and other printables, let's discover where you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection in Is 1099 Q Taxable for different applications.

- Explore categories such as furniture, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets Flashcards, worksheets, and other educational materials.

- Ideal for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates at no cost.

- These blogs cover a wide array of topics, ranging that includes DIY projects to party planning.

Maximizing Is 1099 Q Taxable

Here are some creative ways ensure you get the very most of Is 1099 Q Taxable:

1. Home Decor

- Print and frame stunning art, quotes, or festive decorations to decorate your living spaces.

2. Education

- Print free worksheets to enhance your learning at home also in the classes.

3. Event Planning

- Invitations, banners and decorations for special occasions such as weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars along with lists of tasks, and meal planners.

Conclusion

Is 1099 Q Taxable are an abundance of creative and practical resources that satisfy a wide range of requirements and desires. Their accessibility and versatility make them a valuable addition to the professional and personal lives of both. Explore the vast world of Is 1099 Q Taxable right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly available for download?

- Yes, they are! You can download and print these documents for free.

-

Can I make use of free printing templates for commercial purposes?

- It's all dependent on the rules of usage. Be sure to read the rules of the creator before using printables for commercial projects.

-

Are there any copyright issues in Is 1099 Q Taxable?

- Certain printables might have limitations on use. You should read the terms and condition of use as provided by the creator.

-

How do I print Is 1099 Q Taxable?

- You can print them at home with any printer or head to a local print shop to purchase premium prints.

-

What program do I require to view printables for free?

- The majority of printables are in the format PDF. This can be opened using free programs like Adobe Reader.

Schwab MoneyWise Understanding Form 1099

How To Calculate Taxable Amount On A 1099 R For Life Insurance

Check more sample of Is 1099 Q Taxable below

Form 1099 E filing Requirements To IRS 1099 Reporting Requirements

Form 1099 G Definition

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.20.15AM-ed3d6962a8d74a509a58ce0cab7069bf.png)

Fillable Form 1099 Nec Form Resume Examples o7Y3LqkVBN

1099 Form Tax Id Form Resume Examples kLYrPX726a

What Is A 1099 K Tax Form

Form 1099 NEC Instructions And Tax Reporting Guide

https://www.investopedia.com/terms/f/form1099q.asp

Form 1099 Q Payments From Qualified Education Programs is an Internal Revenue Service IRS tax form sent to individuals who receive distributions from a Coverdell education savings

:max_bytes(150000):strip_icc()/1099-R2022-2372bb9e77514c4a8af4bcc393b6cd36.jpeg?w=186)

https://www.hrblock.com/tax-center/irs/forms/is...

The full amount of earnings as reported on Form 1099 Q is taxable if You re the designated beneficiary You didn t use the funds for your own qualified education expenses An early withdrawal penalty of 10 applies The penalty is reported on Form 5329

Form 1099 Q Payments From Qualified Education Programs is an Internal Revenue Service IRS tax form sent to individuals who receive distributions from a Coverdell education savings

The full amount of earnings as reported on Form 1099 Q is taxable if You re the designated beneficiary You didn t use the funds for your own qualified education expenses An early withdrawal penalty of 10 applies The penalty is reported on Form 5329

1099 Form Tax Id Form Resume Examples kLYrPX726a

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.20.15AM-ed3d6962a8d74a509a58ce0cab7069bf.png)

Form 1099 G Definition

What Is A 1099 K Tax Form

Form 1099 NEC Instructions And Tax Reporting Guide

IRS Form 1099 R 2023 Forms Docs 2023

Form 1099 INT Interest Income Recipient s State Copy 2

Form 1099 INT Interest Income Recipient s State Copy 2

:max_bytes(150000):strip_icc()/ScreenShot2020-01-28at5.14.18PM-95d56fcae5014d0086b8b50d0f01c9ac.png)

Form 1099 Q Payments From Qualified Education Programs Definition